This “How to” describes the configuration process for the components required by DDS Shipper Import/Export web application’s goods invoice control utility:

|

|

|

Right of Access

|

Right of Modification

|

||||||||

2nd example: a user for whom right of access to “DSI_CFC” is unchecked will not see the corresponding menu displayed nor its submenus.

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

|

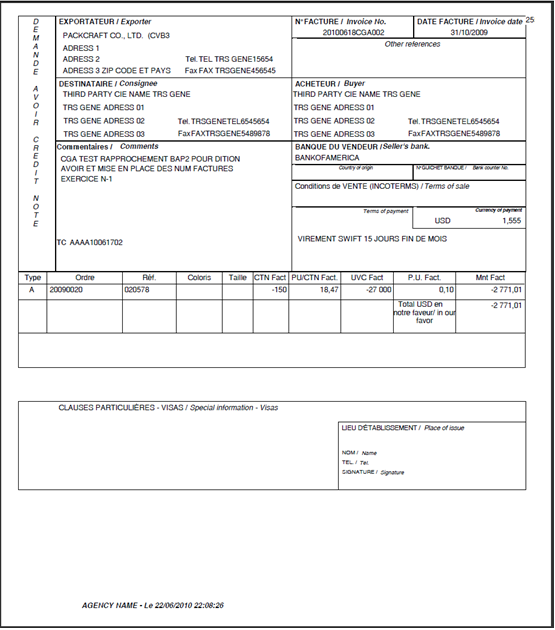

The print template is made available in the invoice reconciliation process if a PA2 code has been issued.

|

Click on the “Print" button. The list of print templates available on this screen is displayed.

To make the most of this print template, the search criteria should be carefully chosen.

|

|

1st page For goods invoices (with and without fees) of 1st supplier,

|

|

|

2nd page for second supplier’s goods invoices

|

|

|

3rd page for fee only invoices (no PA code) of 1st supplier

|

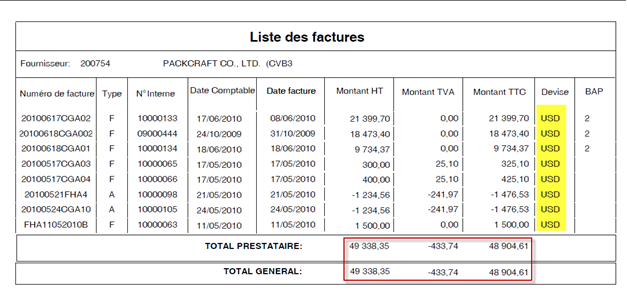

2nd example Single supplier, single currency search

3rd example: Single supplier, multiple currency search

A new Write e-mail window will open.

Click on the “Print" button. The list of print templates available on this screen is displayed.

To make the most of this template, the search criteria should be carefully chosen.

In this case a Send report by e-mail type of window will open.

The invoice fee list is displayed.

For yearly numbering, numbering for the previous and current periods can be handled concurrently.

Prerequisites:

Make sure you enter the last accounting document numbers of n-1 period in the “Previous year last number" field.

The formula must include the year.

Prerequisites:

Make sure you enter the last accounting document numbers of n-1 period in the “Previous year last number" field.

The formula must include the year.

Since penalty management generates a penalty number, the same numbering rules will apply.